Intelligence Into Claims Management

Table of Contents

Imagine you have to file an insurance claim. How does that make you feel?

Talk to Our Automation Expert!

+91 855-975-9735

Want to experience Intelligent Automation in Action or Need help Building the Right Automation Plan?

Overwhelmed, right? The process can feel like a never-ending hassle.

But there is a game-changer that can streamline the whole claims process for you, that can take the burden off your shoulders? It's called insurance claims process automation.

For years, insurance companies have been working on ways to automate as many steps of the claims process as possible. They've modernized their platforms and even started using chatbots. This has helped them become more efficient and productive.

It’s also time to other crunch points too - Artificial intelligence and document scanning tools. These technologies have speed up the claims process while also reducing costs.

One of the biggest pain points is all the manual data entry - names, policy numbers, addresses, and incident details. This is where a lot of mistakes can happen. In fact, insurance companies lose billions every year due to such fraudulent claims.

But with Robotic Process Automation (RPA) along with AI, insurance companies can streamline this whole process.

Let’s read more on this in the following sections:

Automating the Claims Workflow: The Power of RPA in Insurance

The standard insurance review procedure necessitates a great deal of manual input and handling. After an insured individual files a claim, it should be examined, reviewed for fraud, and eventually refunded. Insurance's Robotic Process Automation minimizes the danger of false claims in the following ways:

- Speeds up claim processing.

- Identifies bogus claims.

- Improves client happiness by lowering claim processing time.

- Provides data and insights to assist insurance companies make informed decisions.

- RPA software alerts insurance adjusters to accounts with potential fraudulent activity or claim abnormalities.

- AI also assists insurance companies enabling them to deal with complicated claims.

- As a result, insurance firms receive more information to approve or deny claims faster thanks to AI-powered automation of the claims processing process.

The AI Advantage: Accelerating Insurance Claims with Intelligent Solutions

Claims processing is a crucial component in insurance operations that has a direct impact on customer satisfaction. A report by EY claims that 87% of customers say that their choice of insurer depends on the effectiveness of claims processing.

Historically, this claims processing has been a largely manual endeavor, consuming significant time and resources. And with human involvement comes the potential for errors and limited availability.

A Deloitte survey reveals that while AI has brought success to most businesses, the insurance sector lags, with just 1.33% investing in AI, compared to 32% in software and internet technologies. The upside is that early AI adoption in insurance offers pioneering opportunities and the chance for a bigger share of the rewards.

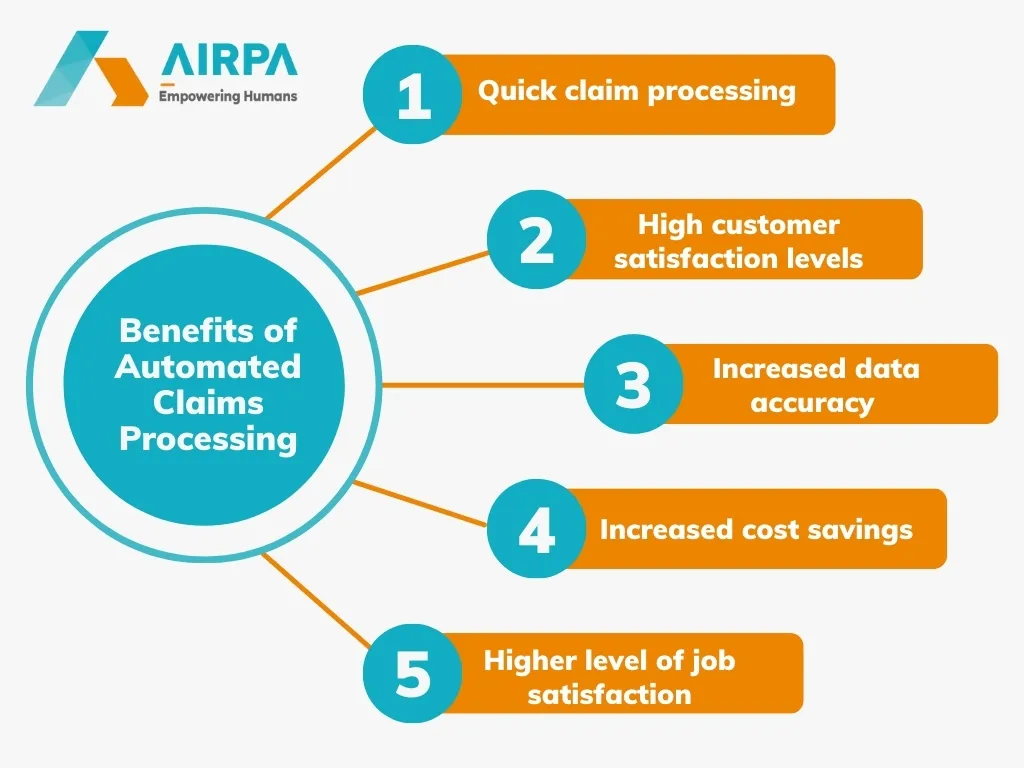

Benefits of Automated Claims Processing

Insurance companies can enhance their back-office and customer-facing services with RPA. Not only does automated claims processing ensure client satisfaction, it also frees up your staff from tedious data entry tasks. The advantages RPA offers your insurance company are as follows:

Quick claim processing

The manual procedure of obtaining information from multiple sources and documents and entering it into other relevant claims processing systems takes a long time. The same process may be accomplished faster with an RPA bot in a single click, ensuring that clients receive prompt responses when they file claims. For example, a bot can simplify the entire claims process, from the First Notice of Loss (FNOL) to adjustment and settlement.

High customer satisfaction levels

RPA-powered claim processing enables a wide range of data-rich operations, from client onboarding to policy cancellation. An RPA bot can switch between several systems and transport data to suit customer requirements with minimal manual intervention. For example, the bot may collect and maintain correct customer and product data, which improves team communication and client retention.

Increased data accuracy

An insurer can reduce the possibility of human error by utilizing RPA bots. Furthermore, data dependability is critical in ensuring regulatory compliance. For example, an insurer can use optical character recognition to automatically scan text from registration forms and accurately enter it into the appropriate systems.

Increased cost savings

Insurance businesses can cut operating costs associated with excessive working hours by delegating routine jobs to RPA bots. Furthermore, staff can focus on revenue-generating duties, increasing corporate productivity.

Higher level of job satisfaction

Using cloud-based claims processing reduces the need for manual data input (as previously stated), allowing staff to focus on more engaging and strategic work that brings greater value and satisfaction. It assists insurance businesses in achieving a low staff turnover rate. For example, RPA technology can extract pertinent information from many sources and enter it into the appropriate system, making it much easier for insurance agents to maintain and access accurate data when necessary.

Why Choose AIRPA's Automation Services?

AIRPA is a leading provider of RPA solutions, assessing everything from planning to implement RPA and ensuring the program is scalable throughout your organization's functions.

AIRPA's powerful RPA technologies enable you to automate tasks at the mouse and keyboard levels with minimal scripting required. Selecting the right RPA provider is critical to successfully integrating this technology into your insurance claims processing operations

If you'd like to learn more, reach out to AIRPA's support staff.

Popular Tags:

Related Articles

How Automation and AI are Reshaping the Fintech Landscape

Is AI the driving force behind fintech's rapid evolution?