AI & Bots-Driven Innovation: The Future of Insurance Operations

Table of Contents

AI waves across the business world are at an all-time high, and you might be wondering… What does AI mean in insurance? The insurance industry is uniquely positioned to benefit from AI due to its reliance on vast amounts of data and the need for precise risk assessment and prediction.

Talk to Our Automation Expert!

+91 855-975-9735

Want to experience Intelligent Automation in Action or Need help Building the Right Automation Plan?

By adopting AI and intelligent automation technologies, insurers can dramatically improve their operational efficiency, risk evaluation, and customer service.

How AI with RPA is Transforming and Impacting Insurance Operations?

AI coupled with Bots can help insurance companies in many important ways. It can do repetitive work automatically instead of people, allowing the companies to work faster and more efficiently. AI is very good at processing large amounts of data quickly to assess risks, review claims, and make decisions accurately. It provides insights that allow insurance companies to better understand customers' needs and create customized insurance plans. As AI gets smarter, it will become increasingly valuable for insurance companies to use it to stay ahead of competitors and satisfy customers better.

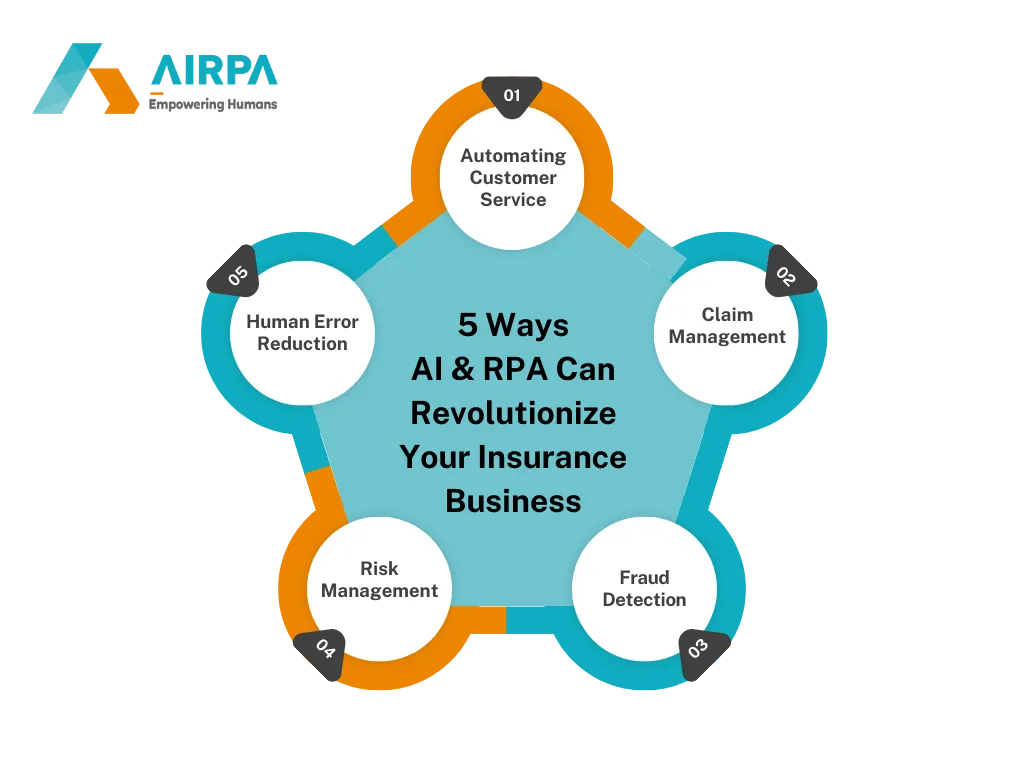

Use Cases of AI & RPA in Insurance: 5 Solutions to Explore and Implement Now

Automating Customer Service

Automating customer service with AI solutions like chatbots, emailbots, and callbots can significantly improve the insurance industry's customer experience. These AI-powered tools can handle routine inquiries efficiently, freeing up human agents for more complex issues. They enable self-service for policy management, cross-selling opportunities, and ultimately increase customer satisfaction and loyalty through seamless interactions.

Claim Management

AI can significantly streamline and automate time-consuming tasks in the claims process. Machine learning models can extract data from documents and transcribe audio, enabling faster processing. AI can also leverage data from IoT devices for better underwriting decisions. Additionally, AI can assist in claims assessment by analyzing data to determine potential costs, leading to quicker and more accurate settlements. Overall, implementing AI solutions can improve efficiency, customer satisfaction, and reduce costs for insurers in claims management.

Fraud Detection

AI and machine learning algorithms can effectively detect and prevent fraudulent insurance claims by identifying anomalous patterns and behavior that human analysts may miss. These AI systems can continuously learn and improve over time to stay ahead of evolving fraud tactics. By raising real-time alerts on suspicious claims, automation technology enables insurers to make better decisions, prevent fraud, and potentially save billions in costs annually while providing fairer coverage to legitimate customers.

Risk Management

AI enables proactive and granular risk management for insurers by leveraging vast amounts of data. It enhances existing processes by quickly analyzing trends from thousands of loss reports. AI and intelligent automations provides underwriters with better risk scoring, pricing models, and payment predictions without replacing human expertise. Studies show AI can increase underwriting accuracy by 83%, reduce throughput time 10-fold, and improve case acceptance by 25%, transforming risk control capabilities.

Human Error Reduction

AI algorithms can streamline the insurance industry's complex and error-prone distribution chain by automating data transfer between sources, reducing manual entry and increasing accuracy. Smart automation techniques allow insurers to develop better products based on accurate assessments and provide automated advice to customers without requiring expertise or agent involvement. This benefits both insurers and customers through improved products and tailored recommendations.

Way Forward

AI and RPA are changing the insurance industry, and companies should act now to gain a much-needed edge over the competition.

In conclusion, the scaling of intelligent automation in the insurance industry represents a pivotal opportunity for insurers to unlock new levels of efficiency, agility, and innovation. This paradigm shift towards AI in insurance is not just about staying competitive; it’s about redefining service delivery, the accuracy of risk assessments, and customer engagement.

AIRPA can help in shaping the future of the industry right from streamlining operations to enhancing customer experience in a revolutionary way.

AIRPA has crafted a straightforward roadmap to guide your insurance company through the automation implementation journey, making it an effortless process. Here are the steps:

- Collaborate with your team to identify the specific business challenges you aim to address and pinpoint the decisions and processes that require optimization.

- Next, assess whether leveraging AI aligns with your business growth objectives and has the potential to resolve those problems and streamline processes effectively. Reach out to AIRPA to schedule an insightful workshop tailored to your company's needs.

- In partnership with AIRPA, develop a comprehensive AI strategy that outlines the optimal use cases to prioritize. Simultaneously, gain valuable insights into the requisite infrastructure and actionable steps to execute your ideal, customized AI model seamlessly.

Popular Tags:

Related Articles

How Automation and AI are Reshaping the Fintech Landscape

Is AI the driving force behind fintech's rapid evolution?